Super Credit loans can be used to purchase properties that are utilised as a business premises for SMSF member or their family.

With a commercial security SMSF can actually occupy the premises or lease it.

Establishment Process

- Engage your tax adviser (if you wish we can assist);

- Establish SMSF if required;

- Obtain funding pre-approval and establish property trust (also commonly referred to as security custodian or bear trust);

- Acquire investment property;

- Initiate Super Credit funding.

Loan terms – 5 to 15 years (at lender discretion)

Maximum loan to value ratio – 70% (at lender discretion)

Minimum loan size – $150,000 (at lender discretion)

Maximum loan size – $5 million (at lender discretion)

Security type – Commercial real estate within acceptable locations

Standard securities are – strata office, factory/warehouse, shop, converted residence (incl. medical rooms/offices).

Non-standard securities are – residential blocks greater than five, shopping/function centres, vacant commercial land, motels, car yards, and purpose built commercial building, caravan parks, and residential development units.

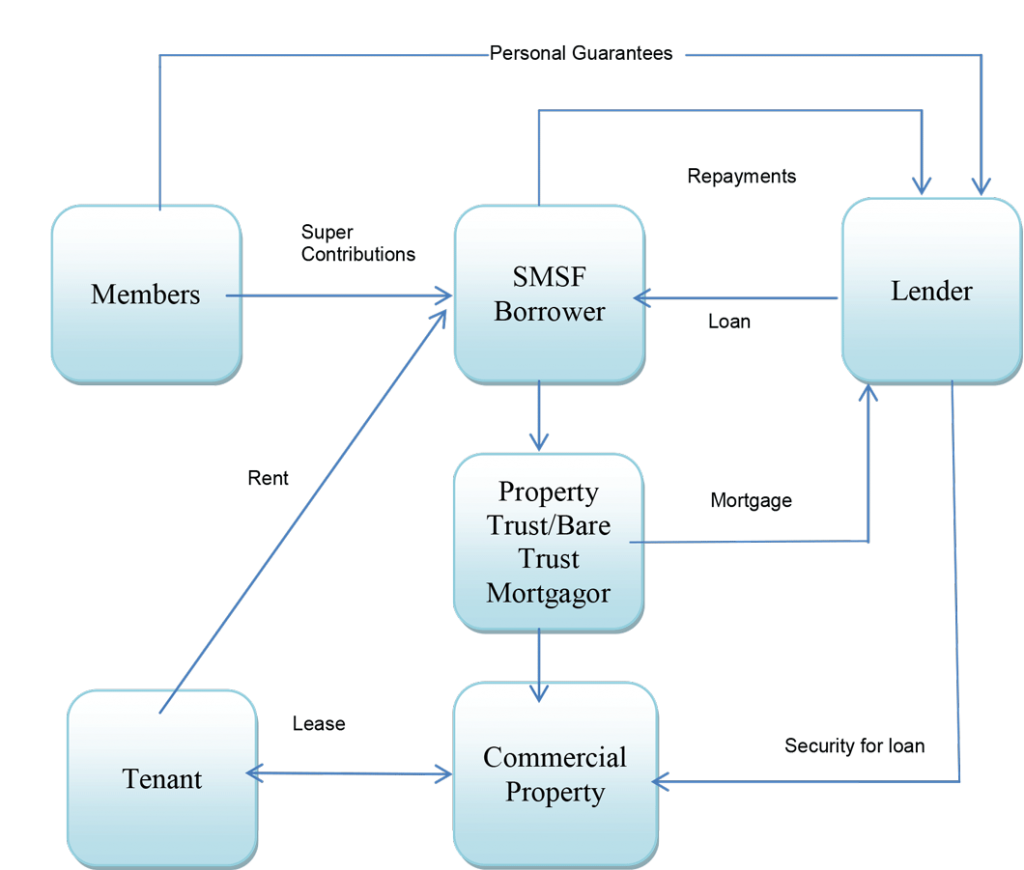

The process to get a SMSF loan can be seen in the diagram below.