Our panel lenders Super Fund Home Loans are designed to provide loans to authorised Australian Self-Managed Super Funds (SMSF) for the purpose of purchasing residential investment property.

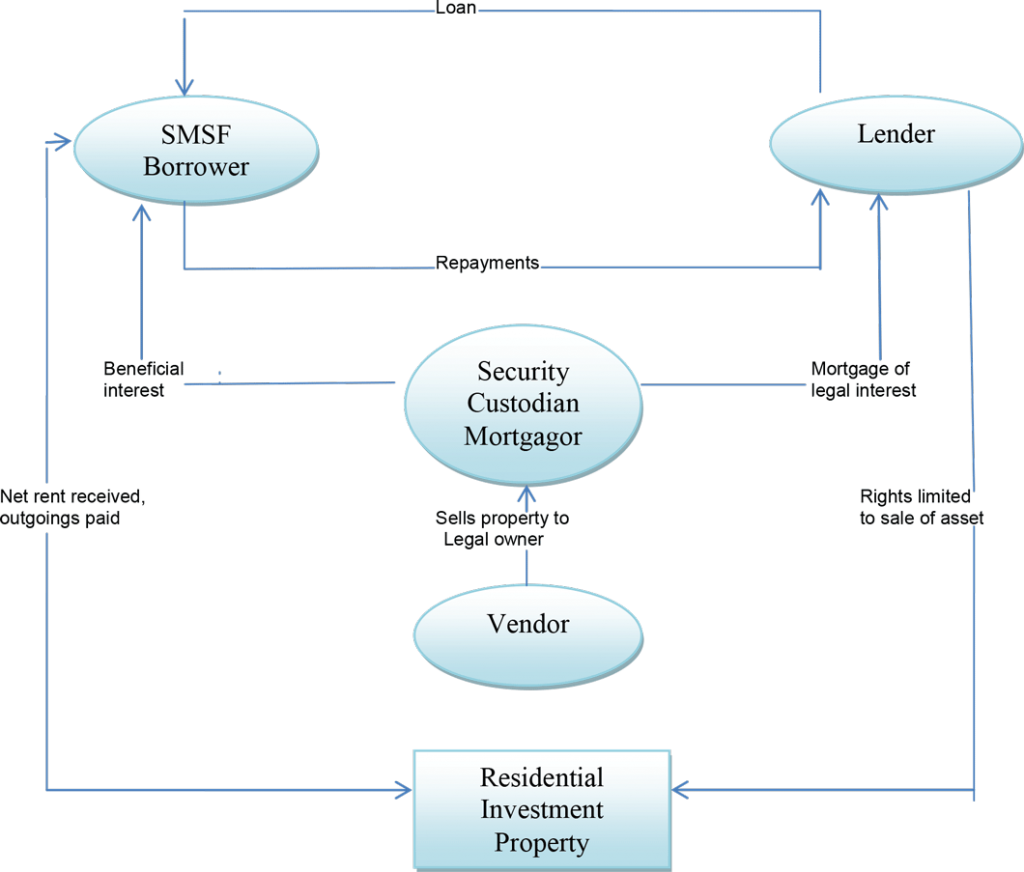

The borrowing structure involves a loan to a SMSF Trustee with a Security Custodian/Bare Trust purchasing the residential investment property on behalf of the Super Fund. This Security Custodian/Bare Trust, must be a limited liability company, then holds the property as an asset in trust for the Super Fund, which has the beneficial right (but not the obligation) to acquire the underlying asset at a future date.

The loan is secured against the investment property and while the loan is ideally self-servicing from the rental income derived from the property, servicing may also come from any other income received or assets held by the SMSF Trustee.

The loan is limited in recourse, with the lender’s right against the SMSF Trustee limited to the lender’s right as mortgagee in relation to the property. There is no recourse to any other assets of the SMSF or to either the SMSF Trustee or Security Custodian/Bear Trust.

Key benefits/target market

The target market is Superannuation Industry Supervision Act (SIS) complying personal Australian Self-Managed Superannuation Funds that are allowed to and wish to utilise debt for investment purposes.

The customer benefits include:

- Diversification of possible investment strategy to include direct property acquisition;

- Flexible repayment options supporting continued investment diversification;

- Potential to accelerate wealth accumulation;

- Potential for improved returns;

- Gearing & Capital Gains Tax benefits may be realised (independent financial advice must be sought).

Minimum loan – $100,000 (at lender discretion)

Maximum loan – $5,000,000 (at lender discretion)

Term – up to 30 years (fixed rate loan available)

Loan Value Ratios for Corporate trustees of SMSF:

- 80% for standard homes (at lender discretion);

- 70% for serviced apartments (at lender discretion).

Loan Value Ratios for Individual trustees of SMSF:

- 72% for standard homes (at lender discretion);

- 63% for serviced apartments (at lender discretion).

The process to get a SMSF loan can be seen in the diagram below.